We’re very excited to announce our new arrival – a feature preview of the Absolute ETF analysis platform is now available on a trial basis to select market professionals – please contact us at info@riskview.io for more information. With a focus on Fixed Income, it’s offers a unique set of features to manage, replicate and analyse the fastest growing segment of the ETF market. In this series of posts we’ll run through the main features of the platform, show examples of the analysis and demonstrate how to get the most out of what’s on offer – click on the headings to take you to the appropriate page for more details. Highlights include:

Advanced ETF Search Functionality: Search by keyword, ISIN, ticker, or use the advanced methods to filter by Assets Under Management (AUM) and Expense (TER) in a single line

Extensive ETF Information and Correlation Analysis: All the key information, total return and correlation analysis showing all the most and least correlated funds with advanced search to filter down the possibilities

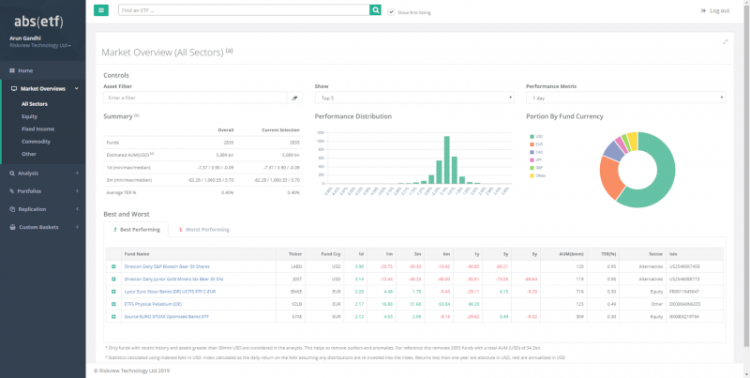

ETF Market Overview: A top down analysis for the whole market with advanced filtering built in.

ETF Portfolio Analysis: Drop in an ETF portfolio and get an instant multi-currency portfolio analysis covering total return, VaR, and efficient frontier analysis.

ETF Bond Replication: The basic analysis allows you to replicate a selection of the largest ETFs with a limited set of component bonds and analyse the performance of the new portfolio. The advanced version allows replication using a list of bonds you supply.

ETF Futures Replication: Creates portfolios of fixed income futures and CDX to match a selection of US ETFs.

Bespoke ETF Analysis: We can offer a range of bespoke services for Fixed Income ETF analysis including a recommendation on converting a portfolio of bonds to a selection of ETFs.

With new features being added frequently, check back or if you have something in mind please feel free to reach out to us at info@riskview.io.