We’re very excited to announce our new arrival – a feature preview of the Absolute ETF analysis platform is now available on a trial basis to select market professionals – please contact us at info@riskview.io for more information. With a focus on Fixed Income, it’s offers a unique set of features to manage, replicate and […]

abs(etf) – ETF Search

While finding an ETF might seem straightforward, the sheer number of funds make finding the exact one a challenge – this is especially true in Europe where multiple tickers across various exchanges make everything that much more tricky. Within abs(etf) we have a number of tools to help you cut through the haystack to find […]

abs(etf) – Fund Information

Once you select a fund you are interested in through the search, the system displays common information and return performance as shown below: You can of course adjust the total return graph and use your mouse to inspect individual points. Using the tabs at the top of the page, if you click on ‘Listings‘ you […]

abs(etf) – Bespoke Analysis

The analytics that power the abs(etf) system are a small part of the wide range of bespoke analysis we can provide to ETF professionals. From advanced portfolio analysis, risk modelling and efficient frontier analysis to complex fixed income replication strategies. An example is for a fund who wishes to convert a portfolio of Fixed Income […]

abs(etf) – Fixed Income ETF Replication

One of the key strengths of the abs(etf) platform is a focus on the fast growing Fixed Income ETFs segment. We offer a number of bespoke services in this area, but the ‘Replication‘ section has a selection of our most powerful tools. The first option is ‘Basic‘ which allows you to replicate a selection of […]

abs(etf) – Portfolio Analysis

Once you have found a number funds you are interested in, we can analyse portfolios of ETFs easily using the ‘Portfolios‘ menu on the left hand side. First stop – click ‘Create‘. This gives you a text box in which you can dump your portfolio – the easiest way is a copy and paste from […]

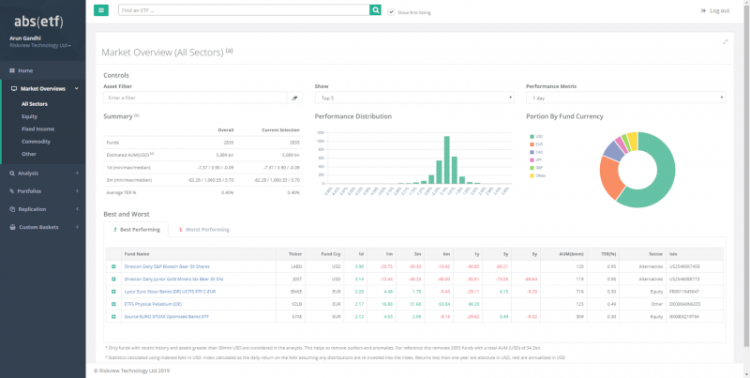

abs(etf) – Market Overview

For the 30,000ft overview of the whole ETF market, select the ‘Market Overviews’ section from the left hand menu. You can select the whole market (subject to an AUM > 50mm to remove very small funds), or filter by particular asset classes. Selecting a ‘1 Day‘ Performance Metric from the drop-down gives the screen below. […]

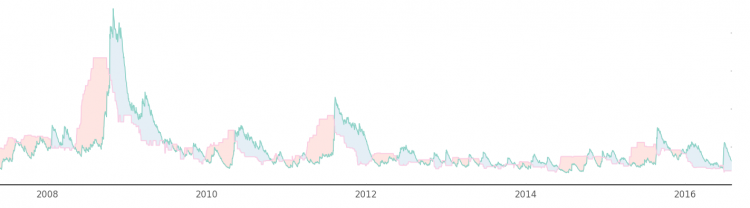

A Primer on VaR/Expected Shortfall: Does it work?

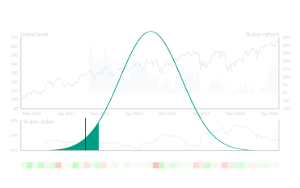

In our previous posts we looked at the definitions of VaR and CVaR/Expected Shortfall in the intro and some real world but point in time numbers in part two. In this post we’re going to try and wrap up with a look at the performance of a simple parametric VaR/CVaR measure over time. In order to […]

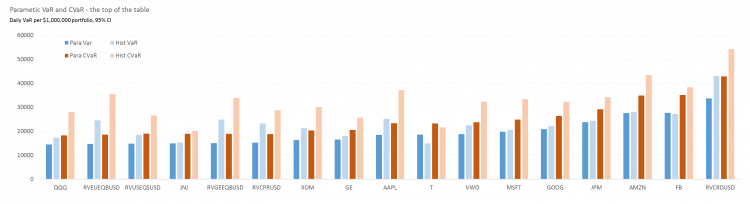

A Primer on VaR/Expected Shortfall: Some Numbers

Following on from the Introduction to VaR, lets get our hands a bit dirty and look at some real world numbers. For want of a better starting place, the charts below show the risk of investing in a universe of 14 stocks, ETFs and futures trackers from the perspective of a USD based investor. They […]

A brief primer on VaR and Expected Shortfall/CVaR

Introduction – I may be in a timewarp. In the dim and distant past I sat beside the team who were creating the original Riskmetrics framework and VaR was the new New Thing to get a handle on the risk of losses from your careful portfolio selection/punting in the markets.