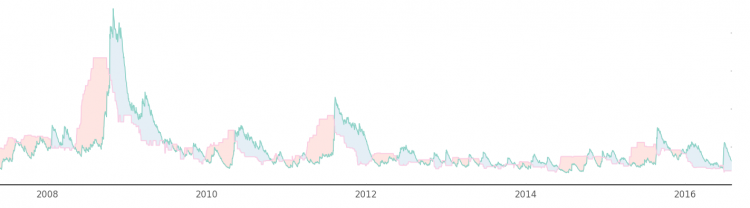

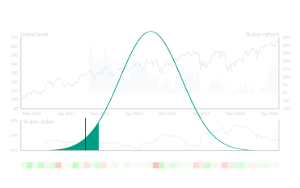

In our previous posts we looked at the definitions of VaR and CVaR/Expected Shortfall in the intro and some real world but point in time numbers in part two. In this post we’re going to try and wrap up with a look at the performance of a simple parametric VaR/CVaR measure over time. In order to […]

Category: Primer

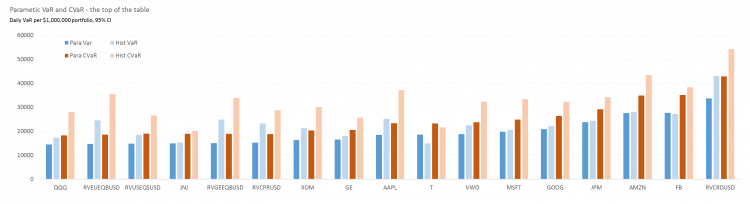

A Primer on VaR/Expected Shortfall: Some Numbers

Following on from the Introduction to VaR, lets get our hands a bit dirty and look at some real world numbers. For want of a better starting place, the charts below show the risk of investing in a universe of 14 stocks, ETFs and futures trackers from the perspective of a USD based investor. They […]

A brief primer on VaR and Expected Shortfall/CVaR

Introduction – I may be in a timewarp. In the dim and distant past I sat beside the team who were creating the original Riskmetrics framework and VaR was the new New Thing to get a handle on the risk of losses from your careful portfolio selection/punting in the markets.